20 Dec Life Insurance: Whole and Universal

Two kinds of permanent policies can keep your loved ones well looked-after once you’re gone. Which one’s right for you?

Life insurance is really all about preparation: It’s something that’s designed to take care of your loved ones after you’re gone. It comes in different forms, meaning there’s some kind of life insurance plan that fits your long-term investment plans and your specific life situation. Most people know about the difference between term life insurance (which only gives you coverage during the term of the policy, after which point it expires) and permanent life insurance (which provide coverage until the day you die). But permanent policies, for the most part, come in two varieties, each of which fits a different kind of long-term plan.

Universal life policies are made with flexibility in mind — flexible premiums, benefits, and savings plans. Whole life policies, on the other hand, are made with consistency as a goal — premiums stay the same, and the accumulation of cash value and death benefits are guaranteed. Both kinds of policies allow you to borrow against their cash value, and both can act like other kinds of investments and earn interest over time.

Is universal life right for you?

If you have ups and downs with your income — if you’re able to contribute much more to a policy some months and then much less in others — then the flexibility of a universal policy might be best for you. It’s also called “adjustable life” because of that flexibility. One advantage is if there’s a better environment for building up your cash value, you can increase your contributions to make the most of it.

That does come with a disadvantage, though. If you happen to pay too little into your premiums too often during lean times, then you might deplete your “cash surrender value,” which means there’s not enough money left to cover the regular fees for maintaining the policy. If your contract lapses, your coverage would end. Also, just as the policy’s cash value can increase with interest rates when they rise, it can also decrease when they fall. Even though there’s usually a minimum guaranteed interest rate, if interest rates plummet to that level, you might have to pay more into your premiums to compensate.

Is whole life right for you?

If you’re ready to pay a consistent premium over a long period of time, and you want the peace of mind knowing that your estate taxes and other long-term responsibilities (like care for an adult dependent) will definitely be covered, then consider shopping for a whole life insurance policy. The total value will be larger than the amount you pay in, because your premium payments (minus fees) are put into high-interest savings or investment accounts, where they accumulate interest tax-deferred.

Some policies let you receive dividends as cash payments, or to use them to pay future premiums or add new services to the policy. You’re also allowed to borrow against the value of the account, and in hard times, can surrender the policy to receive the cash value back.

One disadvantage of whole life is that reliability comes with a cost. These policies tend to be expensive to maintain, and are often more attractive to younger buyers (since smaller payments can add up over a longer period of time).

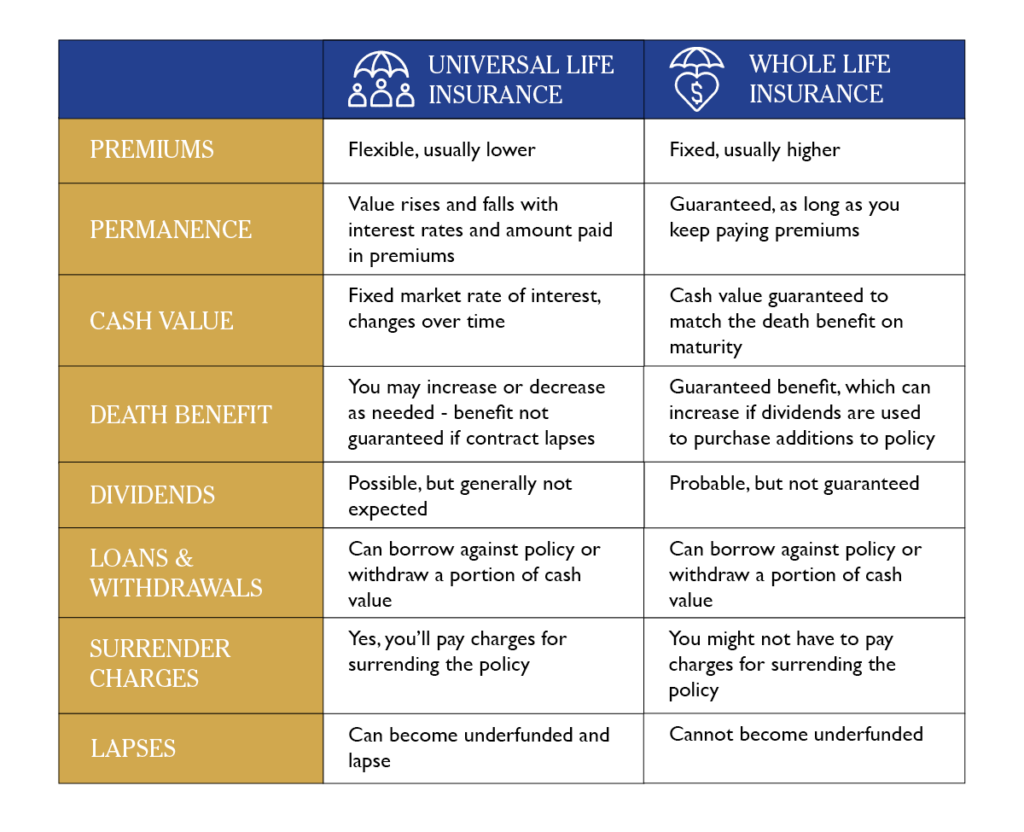

Here are some of the differences:

Whole life gives guaranteed coverage, but that dependability comes with a cost. Universal life has flexibility that might suit your lifestyle (and tolerance for risk) better.

Consult one of our financial professionals to get more details about which policy can best suit your needs.

CONTACT US

Sources:

* https://www.thrivent.com/insights/life-insurance/universal-life-insurance-vs-whole-life-insurance-which-is-right-for-you

* https://www.investopedia.com/articles/pf/07/whole_universal.asp

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a strategy involving life insurance, it would be prudent to make sure you are insurable. As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges; if a policy is surrendered prematurely, there may be surrender charges and income tax implications. You should consult a qualified tax professional for tax advice on your own personal situation. All guarantees are based upon the claims-paying ability of the issuer.

Accessing cash values may result in surrender fees and charges, may require additional premium payments to maintain coverage, and will reduce the death benefit and policy values. Excess policy loans can result in termination of a policy. A policy that lapses or is surrendered can potentially result in tax consequences. You should consult a qualified tax professional for tax advice on your own personal situation.

Optional riders and benefits may be subject to eligibility requirements, additional premium requirements and/or minimum or maximum coverage amounts. Availability and rider provisions vary by each state.

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a strategy involving life insurance, it would be prudent to make sure you are insurable. As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges; if a policy is surrendered prematurely, there may be surrender charges and income tax implications. You should consult a qualified tax professional for tax advice on your own personal situation. All guarantees are based upon the claims-paying ability of the issuer. Accessing cash values may result in surrender fees and charges, may require additional premium payments to maintain coverage, and will reduce the death benefit and policy values. Excess policy loans can result in termination of a policy. A policy that lapses or is surrendered can potentially result in tax consequences. You should consult a qualified tax professional for tax advice on your own personal situation. Optional riders and benefits may be subject to eligibility requirements, additional premium requirements and/or minimum or maximum coverage amounts. Availability and rider provisions vary by each state.

6065593RG_Dec25

No Comments